Some planseven require a person to pay only the Medicare Part B premium and 0 forprescription. Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. This means you will pay 20 of the Medicare. A 20 copay after you meet the annual deductible. Explaining the Prescription Drug Provisions in the Inflation Reduction Act. Medicare Advantage, onthe other hand, has a lower premium but higher out-of-pocket costs. Medicare Part B Out-of-Pocket Expenses A 226 annual deductible. Announcement of calendar year (CY) 2022 Medicare Advantage (MA) capitation rates and Part C and Part D payment policies.

You cannot avoid all out-of-pocket costs, but you can do your best to minimize them. Note to: Medicare Advantage organizations, prescription drug plan sponsors, and other interested parties. Seven ways to minimize out-of-pocket costs. Exempted groups include children, terminally ill individuals, and individuals residing in an institution. The Part D donut hole.Ĭenters for Medicare & Medicaid Services. Generally, out of pocket costs apply to all Medicaid enrollees except those specifically exempted by law and most are limited to nominal amounts. Monthly premium for drug plans.Ĭenters for Medicare & Medicaid Services. Yearly deductible for drug plans.Ĭenters for Medicare & Medicaid Services. doi:10.1002/acr.21696Ĭenters for Medicare & Medicaid Services.

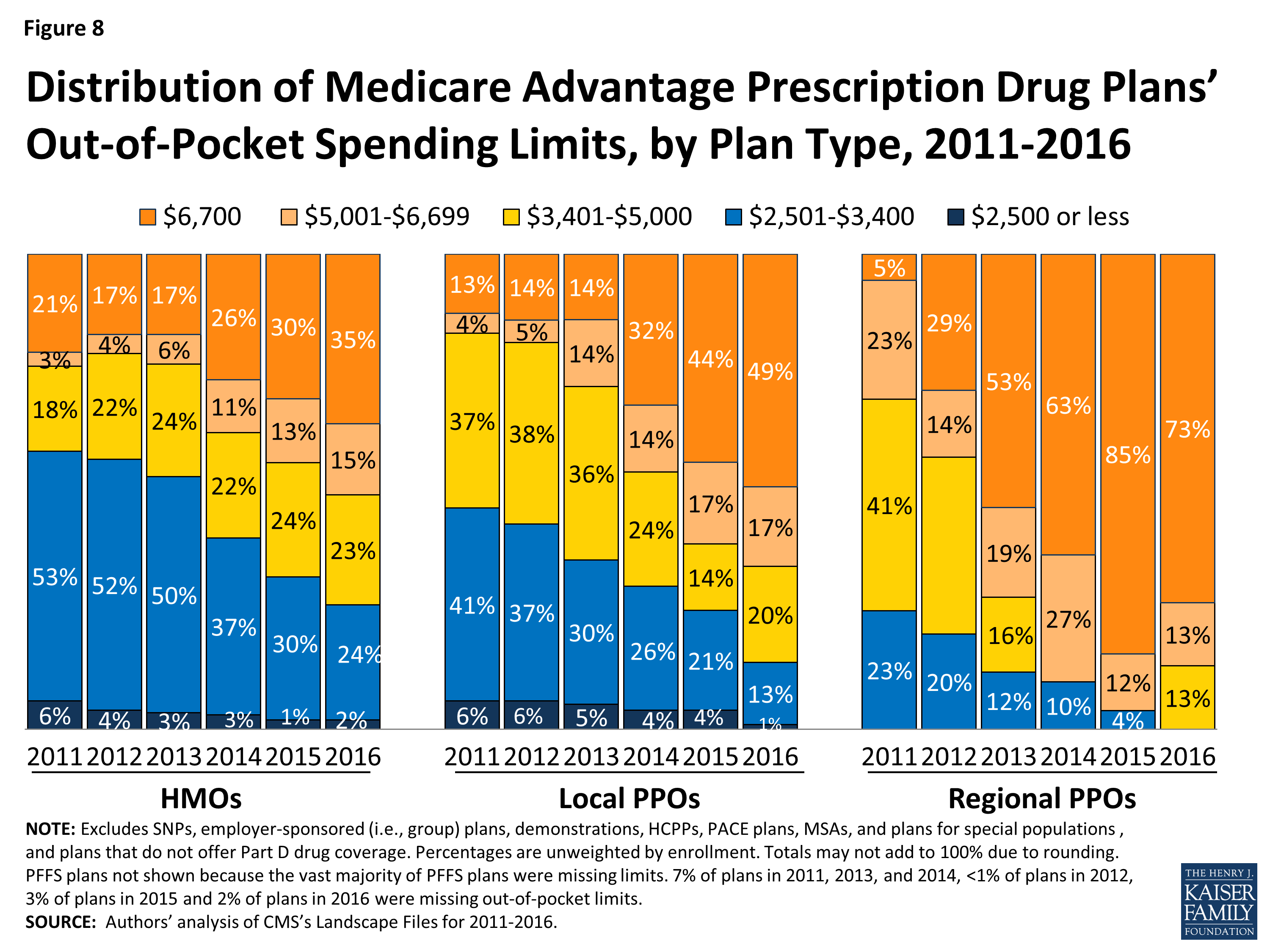

Out-of-pocket costs are only incurred if and when you need. If the plan decides to stop participating in Medicare, you. You should consider this when choosing a plan. The Extended Medicare Safety Net provides assistance to meet out-of-pocket medical costs, but evidence suggests that most of its benefits go to higher. Each plan can have a different limit, and the limit can change each year. Once you reach this limit, you’ll pay nothing for covered services. Impact of Medicare Part D for Medicare-age adults with arthritis: prescription use, prescription expenditures, and medical spending from 2005 to 2008. The monthly premiums you pay in order to have coverage are not included in out-of-pocket costs. There is no limit to the out-of-pocket costs you may have to pay for original Medicare, which includes Medicare Part A and Part B. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. For more information about Medicare including a complete listing of plans available in your service area, please contact the Medicare program at 1-800-MEDICARE (TTY users should call 1-87) or visit Medicare has neither reviewed nor endorsed this information.Cheng LI, Rascati KL. Each Blue Cross Blue Shield company is responsible for the information that it provides.

OUT OF POCKET EXPENSES MEDICARE HOW TO

To find out about premiums and terms for these and other insurance options, how to apply for coverage, and for much more information, contact your local Blue Cross Blue Shield company. One way to lower your out-of-pocket costs is by exploring Medicare. Enrollment in these plans depends on the plan’s contract renewal with Medicare. A: According to a Kaiser Family Foundation (KFF) analysis of Medicare Current Beneficiary Survey (MCBS), the average Medicare beneficiary paid 5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed. This means once you have spent up to a certain amount then you will get more money back from the government for your out-of-pocket expenses. The Part B costs above apply if your only coverage is Original Medicare (Part A and Part B). When your out-of-pocket expenses go above a certain threshold, you will be able to claim higher benefits from Medicare. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract. Medicare calculates how much you are out of pocket each calendar year (the difference between what the doctor charges you and what you can normally claim back from Medicare).

Plans are insured and offered through separate Blue Cross and Blue Shield companies. Viewing this Medicare overview does not require you to enroll in any Blue Cross Blue Shield plans. Median annual out-of-pocket costs in 2019 for 28 of the 30 studied specialty tier drugs range from 2,622 for Zepatier (for hepatitis C) to 16,551 for Idhifa (for leukemia), based on a full. Medicare overview information on this website was developed by the Blue Cross and Blue Shield Association to help consumers understand certain aspects about Medicare.

0 kommentar(er)

0 kommentar(er)